Credit rating measures your profitability to the credit industry, if you pay off your loan early, they make in interest, thus less profit.

Not entirely true. I’m what they call a deadbeat (meaning I pay off my cards in full every month and have been doing so for the past 10 years, making them $0 profit), and I have a 800 score.

I think the more correct way to think about it is that it’s an estimate of your profit potential. What everyone tells you to do with a score this high is to buy a house because you qualify for the best mortgage interest rates. But of course then they’ll have me on the hook for the next 30 years, and they stand to make in excess of $100k in profit.

100K profit on a mortgage? that’s insane

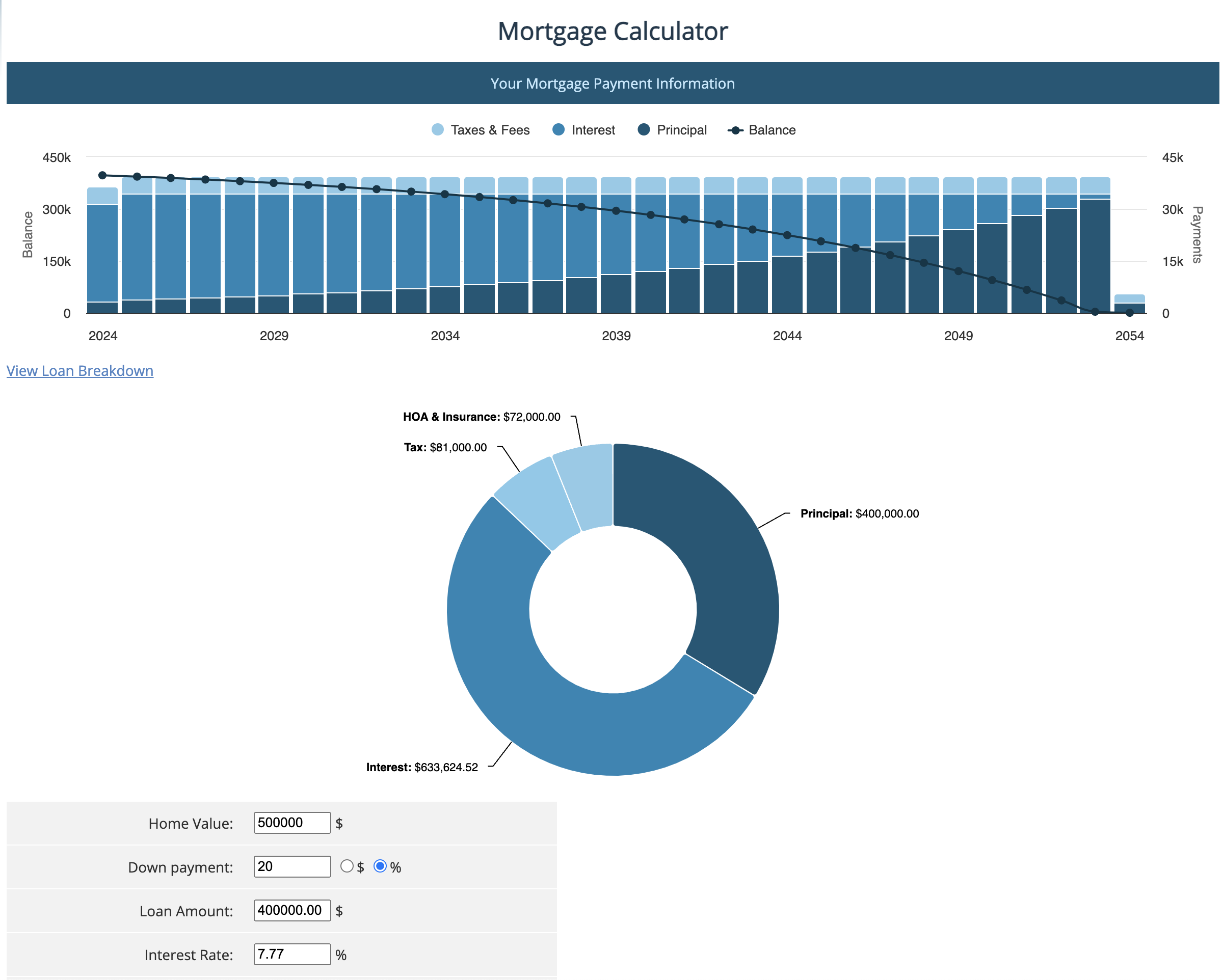

It’s actually far worse than that. If you get $400k loan at the current rate and pay it off over 30 years, you’ll end up paying over 1.5x times the principal in interest. Over the lifetime of the loan, a $500k home will cost you over $1M.

(from mortgagecalculator.org)

Wait why are the banks investing in home loans when instead investing that money into the stock market (should?) yield greater returns over the course of the loan period (even at a very conservative 5% yearly compounding interest, $400,000 turns into $1.7M over the course of 30 years)

Mortgages are “secured debt”, meaning that they are backed by a collateral (in this case, the house). If the person defaults, the bank can seize the house. The risk is lower, and thus even when the interest rate is lower, the bank is willing to take it.

Mortgages are fixed income. Stock market returns are variable and therefore riskier. One bad year can wipe out multiple years of gains. Meanwhile, the money you collect as interest has already been paid, and as you can see from the calculator, the interest is front loaded, meaning the majority of it is paid at the beginning of the loan. So even with the probability of a default wiping out the remainder that’s owed, it’s still a much safer investment.

Why aren’t these practices considered criminal?

What is your proposed alternative system? All of this is just an interest rate applied to an outstanding balance. Many less people would own a house without such an option.

Cool it with the antisemitism, will ya?

Because the people and organizations with the capital to loan out millions of dollars for house purchases are the ones who make the rules.

jeez, my apartment is fixed at 1% for 10 years, my house for some reason I didn’t think about fixing it for longer and it’s 1% for only 5 years, but even now that mortgages are peaking in my country they don’t go over 6%

That would imply people who constantly carry credit card debt would have high credit ratings, which is false as far as I understand.

no it wouldn’t, due to the higher risk of them not peying it back

It’s not, really, although it’s a bit more nuanced than that.

Credit scores are now taking in more information than ever, so things like your debt repayments as a % of your income (affordability) are feeding in as well.

For the people carrying credit card debt, one CRA might give you a better score if you carry a balance >0 but <25% of your total credit limit, and another it could be 0 to 40% so you will see some score variability.

If your utilisation is higher your score may suffer. This is only one aspect, though. Repayments on other debt (mortgages, utilities, mobile phones) play a part, as do things like voter registration and the time you have kept open your accounts. TransUnion is now incorporating BNPL (like Klarna) data for some reporting, although not sure it feeds into the score view yet).

I would highly recommend using whatever free apps are available for each of the CRAs (TransUnion, Experian and Equifax are the three main providers) to monitor your score.

For TransUnion you should be able to use the Credit Karma app in both the US and UK, and in the UK you also have the ClearScore app for Equifax score.

Experian in the UK is on the process of removing 3rd party app access (would have been MoneySaving Expert app before, but that’s moving to TransUnion).

Voter registration?? So you get a higher score if you’re a certain political party. Alrighty then.

I wish they were transparent about what exactly they use and how they use it, not what they’re saying they “may” use.

No it’s nothing to do with political affiliation at all,

And someone has already replied about the UK which is largely where my experience lies in this area.

Voter registration (entry onto the electoral roll) is additional confirmation that the address you are using for other credit/loan information is accurate.

Not sure which part of the world the above poster was referencing, but I wanted to highlight that in some countries (like the UK that is briefly mentioned) registering to vote doesn’t come with a political alignment, it’s merely registering to vote.

From what I recall that is definitely a factor in credit ratings here in the UK, and may well be in other countries as well.

Can someone explain why the credit score is so important for americans? Are most of them getting loans for things to live?

Most Americans can’t afford a $400 emergency and live pay check to paycheck. Car breaks down, emergency medical expenses, emergency house breaks down could all cost over $400. You need a Credit card for that back up that you could eventually pay back by probably sacrificing something else. Need a car need a credit score or you pay $3-10,000 more in interest same with buying a home. Want to rent need a credit check. Want to get a job at a bank, military contractor, some government positions, and other secure jobs. They want to make sure you don’t have bad credit or can’t be taken advantage of . Which no credit is often considered bad credit.

Even apart from its necessity for getting bank loans at reasonable interest rates, most landlords check your credit score before renting an apartment or house to you. If your score is low you’ll have trouble finding anywhere to live and you might have to live in your car … if you can even afford a car without getting a bank loan for one.

Yes, they use credit cards for almost everything and I think it’s expected of them to have one when they become adults.

An american can explain this better than me.

Your credit score can affect the interest rate of getting an auto loan or a home loan. Most adults will have a credit card to establish credit history but won’t be using it to get by. Some might use it for stupid purchases though.

Not just credit cards, you want a car, or a phone, or a place to live? I’ve even hear of some employers asking to check the credit of potential employees, were suppose to always be in debt, because our out of control capitalism means the average person can’t afford anything, it must be financed.

I paid a credit card down from $1700 to $1200. My score went from 795 to 763. Fuck 'em and their fake money.

You’re still carrying a balance of $1200 though. Pay it off and it should go up.

Believe it or not, it is better for your credit score to carry a low balance on your credit accounts than no balance, because glue tastes yummy to the credit agencies, I assume.

You only need a balance on the day the company reports to the credit bureaus. They have to and will tell you the day they do this. You can buy something the day before and pay it off the dat after and never have a balance on your statement and still appear to be using credit.

it is better for your credit score to carry a low balance on your credit accounts than no balance

That’s a myth that credit providers like to persist because it tricks people into paying interest. Pay off your credit card every month, don’t carry a balance, and use less than 30% of your available credit. That’s what’s best for your credit score.

Please don’t spread that myth. You’re literally helping people fall for the trap you’re complaining about.

https://www.cnbc.com/select/what-is-a-good-credit-utilization-ratio/

"Why you shouldn’t go as low as a 0% credit utilization rate

If your CUR is 0%, it shows lenders and credit card issuers that you aren’t making any purchases on your credit card. Remember, it’s important to use your card.

“When a credit card account is reported with a zero balance, some scoring models will look at a zero balance as if the card is not being used,” Droske says. “Maybe it’s in your drawer at home, or, for whatever reason, you aren’t using it at that point. Not using it at all is not as good as using it in very small, controlled ways.”

While a 0% utilization is certainly better than having a high CUR, it’s not as good as something in the single digits. Depending on the scoring model used, some experts recommend aiming to keep your credit utilization rate at 10% (or below) as a healthy goal to get the best credit score."

It’s not a myth. I keep a 0 debt load because I don’t want to be bothered playing the game for another 20 points, but a low balance increases your score a little over a 0 balance.

I despise capitalism, and I know my enemy well. Credit utilization matters beyond This is how credit scores work.

Your source does not seem very definitive.

“Depending on the scoring model used, some experts recommend aiming to keep your credit utilization rate at 10% (or below) as a healthy goal to get the best credit score.”

But even if carrying a single digit CUR is the optimal way to maximize your credit score, paying off your cards is going to be the best advice for 99% of people.

And even Experian, the credit reporting agency says carrying a balance helps your score is a myth.

paying off your cards is going to be the best advice for 99% of people

No duh, this isn’t asking for financial advice though. This post was about what maximizes your credit score.

Two entirely different things.

Also, you linked to an ad for what experian wants to sell you. The credit agencies have proven time and time again they are the last source of information you want to use regarding how they generate credit scores, when they aren’t proving they can’t be trusted with your data and should be dissolved by government for their constant data breaches it’s almost impossible to opt out from while still participating in society.

“Carrying a credit card balance will not benefit your credit score, but enrolling in Experian Boost®ø has helped many people increase FICO® Scores based on their Experian credit reports, and a free credit score from Experian can help you track progress toward score improvement.”

-Your source. A sales pitch is never a valid source, unless it’s to prove someone tried to sell you something.

You guys are talking about different things.

Credit utilization of 0% doesn’t mean paying your cards off on time every month so you avoid interest. It means paying your cards off before the statement period even closes so nothing is reported to the credit agencies.

I do this. All my cards have a statement period ending on the 19th or 20th. Around the 17th every month I pre-pay so my statement is $0 on every card.

When I use a card after doing this and the charge goes through before the statement closes, my FICO score goes up (vantage doesn’t seem to do this).

For the last 18 months or so my FICO has been going up 22 points every time there is at least a little balance to report and down 22 points every time my credit utilization is 0.0%.

You can have debt utilization while still paying off the full statement balance each month and not being charged interest. I always have a balance, but I rarely carry the balance beyond the statement due date and interest free grace period. (I just have new charges that make the balance non zero.)

Or, hear me out, he could go all Tyler Durden.

That’s probably not a good long term decision.

Your face is not a good long term decision.

That man had a family!

Also probably not the best decision.

Some institutions deserve to die.

It won’t, necessarily. They don’t want people who will pay off their debt, they don’t make money off of interest if you pay your debt off. They want people constantly in debt making monthly payments.

Source: I paid off lots of debt and my score plummeted.

Your score could have gone down because closing the account effected the length of your credit history, or because the credit mix (types of accounts) was changed, or because the account showed the entire loan amount as available credit which was removed when the account was closed. Yes they make money off of people who carry some balance but they track credit scores to attempt to predict whether a person will repay credit that is offered to them.

*Laughs in european

At least in France, they look at your income, your eventual debt monthly payments, and see if you will be able to pay more or not.

A lender will look at those things, as well as a credit score. Lots of folks in this thread are mistakenly trying to make credit score more than it is.

That’s not at all a universal rule, and a low credit score can even affect employment in the US.

FICO Credit scores weren’t even invented until 1989, when the US middle class began it’s slow death.

Paying off loans early lowers your score. Using a credit card with a higher limit increases your score. It’s never ever been a way of establishing that a person is trustworthy to receive a line of credit, it is a scam to put more people into debt and keep them there.

No one opts in to have a private company collect (and lose) their private information. You’re born into a credit score.

Ive only ever carried a mortgage and a small car loan as debt. My cc are paid in full every month. My credit is consistently well into the highest category. It’s certainly a game, but an easy one to play if you have any type of self discipline, and I’ve never felt like it’s kept me in debt.

I’d say inb4 someone high on copium tries to justify it, but I’m already too late.

Some people love taking time out of their day to type out at least one full paragraph on why this is okay and makes sense! When we know it doesn’t, but they sure try their darndest to justify it.

What a waste of time and nonsense.

Tell ya what, I got a plan! We go back to the way it was before credit scores. If you’re white, socially acceptable, know your banker and are a deacon in your church, you’re approved!

“nOt LikE thAT!”

Children: I don’t understand how this works so it’s unfair!

Just because the old system was worse does not mean we can’t have better than the current system.

Normal countries don’t have credit scores. It’s once again a US-only problem.

Lmao what? I’m from a third world country and credit score is a thing here.

USA?

DAE that USA iz a third world country. I iz a geneus.

🤦♂️

Come live in an actual third world country, live the way average citizen in that country live, and you’ll be yearning to be in USA instead by week 2.

Fuck this dumb circlejerk.

Wait… Seriously?

I knew it was ridiculous (literally two companies who assign you a numeric value in an arbitrary range and refuse to elaborate why)

But I never considered other places not having some version of this, probably run by the government (or are just using ours)

Can you walk me through how getting a loan works? Let’s say a home loan, what would they ask and what decides the terms you get?

I’m not the person you asked but there aren’t credit scores where I live (Netherlands).

First of all when you take a loan it’s officially registered with the Bureau of credit registration. Yes paying of a loan nicely will still help but not having any loans at all is usually better. If you already have a loan you can’t loan as much money. So there’s some kind of system but generally loaning as little ad possible is much better. There’s no score though, just positive and negative registrations. Every loan above 250€ is registered. This includes stuff like a phone subscription with included phone.

Besides that if you want loan the lender will ask for income and expenses.

Also almost nobody ever uses credit cards. We all just use debit cards. So you can’t spend what you don’t have.

There are numerous proprietary score algorithms out there. The newer ones seem to have fixed this bug by factoring history of closed accounts but many online “free credit report” services still use the old ones.

Old algorithms would often penalize account closure due to sudden reductions in average credit age, available credit, or credit mix (any of which might apply to the OP, but especially if that car loan represented a significant portion of their credit history).

Likewise, they would sometimes reward new debt if it significantly increased available credit or added a unique credit type to the mix. For example, a first mortgage could bump a credit score by 30 points or more, even though the individual is no more credit worthy than they were before.

Regardless, I think a good thing to keep in mind is that banks tend to maintain their own internal scoring systems. So not only is there no such thing as “THE score,” but the scores people are referring to when they say that are mostly just one credit bureau’s estimate, based on their proprietary rubric, of how a lender MIGHT see a potential borrower’s likelihood of default.

The banks often use the score by such scoring companies, as those scoring companies have access to all sorts of contracts, bank accounts etc. you have. Wheras you bank only has information provided directly by you.

The scoring companies can have tremendous impact on your life and often they use completely bullshit factors, like your postal code, where you are punished for living in a “poor” neighbourhood or rewards for living in a “good” niegbourhood.

There is also credible reports of ethnical discrimination, e.g. if your name is not a “white” name.

The scoring companies should be obliged to provide full disclourse for how they define a score and banks should be demanded to provide information, if they denied a credit based on such a credit score, with full liability of the scoring company, if their score was using discriminatory criteria.

The banks often use the score by such scoring companies, as those scoring companies have access to all sorts of contracts, bank accounts etc. you have. Wheras you bank only has information provided directly by you.

Banks see the full credit report you see, not just the score. Using any of the specific scoring models (like FICO 2.X, VantageScore 3.X, whatever) championed by the various credit bureaus is optional.

The scoring companies can have tremendous impact on your life and often they use completely bullshit factors, like your postal code, where you are punished for living in a “poor” neighbourhood or rewards for living in a “good” niegbourhood.

Uh, this is quite a claim dude. How easy would it be to detect and verify that credit bureaus are using borrowers’ associated addresses substantively in their nationally deployed scoring models? I’d wager a college student with an excel spreadsheet and a one-line mailer could do this in a single semester. Now consider the CFPB auditor, with direct records access. How long would that take?

There is also credible reports of ethnical discrimination, e.g. if your name is not a “white” name.

Again, think these conspiracies through. Credit reporting agencies are fancy bookies in the end, right? They live and die by the legitimacy of the service they offer. So if one of their scoring models has worse predictive accuracy because some executive is evil, and wants to fuck with some group of people, no one will use it. Not even because it’s evil, just because it sucks.

The scoring companies should be obliged to provide full disclourse for how they define a score…

Bro, good news! They are. It’s called the Fair Credit Reporting Act. https://www.consumerfinance.gov/rules-policy/final-rules/?topics=credit-reports-and-scores

Look I hate being forced to defend fucking credit bureaus of all things but conspiracy theories like the ones you’ve described distract from real systemic injustice and disrupt real collective action.

Well in Germany there is currently an ongoing dispute because the main credit scoring company refuses to disclose the details of its scoring algorithm.

I would also disagree on the banks interests there. The banks don’t see the customers they loose because of an overly restrictive scoring model. Also for them to see things like discrimination based on names they first would need to develop a sense to question their own prejudices. Something that white people in Germany, and given the constant issues of racial discrimination, i’d dare to claim in the US too, struggle with extensively.

I want to ask on this though:

At least in the US, banks see the full credit report you see, not just a number.

Do you mean the report provided by the scoring company? Or is there a national register, where all your contracts, credit cards, bank accounts etc. are stored and all banks can access it? That is what i mean. W.o. the scoring company, the bank only knows about the business you have with them and what you disclose to them. They don’t know wether you have an overdrawn credit card with a different bank. At least that is how it is in Europe.

I hadn’t heard about the dispute in Germany but found some articles about it. If I’m reading correctly, I would say practices were definitely not more responsible in the US, but the history of disputes here may go back a bit further, with a slew of regulatory reforms we benefit from today — namely FCRA, TILA, BSA (1968-1970), ECOA, FCBA (1974), RFPA (1978), and FACTA (2003).

For them to see things like discrimination based on names they first would need to develop a sense to question their own prejudices.

I definitely agree regarding the universality of blindness to such biases. I suppose automated credit decisions (based purely on scoring models) might have a better shot at eliminating the factor of implicit biases in human agents. Even so, there is a lot of debate over here about how best to filter data that reflects biases and also what data is currently being ignored due to biases, because any algorithm that solves these issues, in part or whole, allows better value capture and increased revenue.

The banks don’t see customers they loose because of an overly restrictive scoring model.

Perhaps, but even if their stakeholders don’t notice or care about discrimination at all, they do take notice when a competitor scoops up a portion of the market they failed to realize due to biased/inferior analysis. After all, the original goal of credit scoring was to increase objectivity and predictive accuracy by reducing bias for the sake of better (more profitable) lending decisions.

To your question re: the credit reporting system in the US, it sounds like it works a bit differently here. There are credit bureaus (sometimes called “reporting agencies”) such as Experian, TransUnion, and Equifax (“the big three”). They functioned historically as lending history aggregators, but now also have scoring models they develop and sell. There are also companies who specialize in scoring models, but they use data from the credit bureaus. These companies often tailor their models to specific markets.

In general, if you apply for any form of credit, the lender formally submits a requisition (a “hard inquiry”) for your file (a “credit report”). Only very specific information is allowed in that credit report, and it must be made available to you at your request (free annually, otherwise for a nominal fee). There are other situations where credit scores can be ordered as a “soft inquiry” without the report, and there are particular rules and restrictions that apply, but the lending history contained in your credit report is what banks and lenders routinely use for applications, even automated/instant credit decisions.

The numbers Mason, what do they mean?

Money is the worship of a pure abstraction. Money is religion. It’s the religion we were all inducted into. We perform rituals to gain the symbolism of our worship in the form of papers, sing metals, and abstract credit. We have faith in our religion, based on the morality and parables we’ve created around it. Should you lose your faith In the great pure abstraction, there are many broadcasts that evangelize it, justify its existence, and tells you how to live by its virtues.

A 35 point drop should either be a temporary blip, or a result of having practically no other credit.

A significant portion of your credit score is the average age of accounts. When an account closes, that is no longer accumulating time (this is also why you should just keep credit cards you aren’t using open, and if they have an annual fee, have the issuer change it to a free card if they can, I.e Chase Sapphire down to Freedom).

Another portion of the score is debt-to-limit ratio. If that goes from $250:$10,000, down to 0:0, you look a lot worse as a credit customer.

I don’t think that changes the fact the system is illogical and stupid though. It’s way too basic a system if that’s how they’re running it.

The system was built around the needs of the upper middle class and it suits them just fine. Someone earning $500k+ per year will have a whole lot of credit cards, loans, mortgages, etc. That diversity helps them generate the scores they need.

You’re spot on. I do want to point out, though, that upper middle class in the US is a household income of 90k to 150k. 500k would be solidly upper class. My apologies if you’re referring to a different country.

I suspect that those numbers may be higher now, though. $90k won’t buy you a house in any sizeable city, you really need to be at the $150l+ level. I take your point that $500k may have been a bit of an overreach in my original comment.

$500k/yr. isn’t “upper middle class. That annual income is in the 99th per win the US; it’s literally a 1%er.

It’s pretty good for most people. There will be outliers.

The problem is, we have massive faceless banks that cater to nearly everyone. They need some system to gauge how much of a risk an individual lendee is.

The only real fair way to do that is based upon their reputation with other creditors over the past so many years. There’s a lot of metrics they can use ti measure that reputation, but all of them suck if you have little-to-no reputation to begin with.

Small community banks and credit unions had some more flexibility here since the bankers knew you, personally. However, I think it’s pretty obvious how subjectively judging someone’s credit worthiness can have some serious consequences based upon any -ism or -phobia you can name.

Maybe we just shouldn’t have massive faceless banks then? No one is asking for that

But we, the consumers, did. By putting all our money in them, and continuing to bank with them as they gobbled up all the local banks and became mega banks.

It’s a consequence of the barely-regulated capitalist system that we have, sure, but it was driven by decades of consumer (mostly boomer) complacency.

I never asked for my bank to be bought by another bank. I have no say I’m the matter and it keeps happening. Pisses me off every time. I switched to a credit union

From what I understand it’s a pretty shit system that doesn’t work that well.

From the example posted here, it’d be extremely trivial to set up a system that doesn’t deduct points because you paid off a debt. That makes zero sense.

Some dude may have come up with a basic model 20 years ago but it needs updating - any half decent data scientist at this stage would be able to build a better system.

A lot of the FICO scores (there are different scores for different things) don’t ding you for it, but most of the monitoring apps use Vantage.

I find the difference between my FICO 8 and Vantage 3 to be as much as 100 points. Most people seem to have higher Vantage scores, but my FICO tends to be higher. They’re different companies that use different systems.

This is the kind of thing that seems good on paper, but in practice it alienates anyone on the outside of it. If you’re born into a low credit score (i.e. born poor) you’re automatically at a disadvantage. No one will lend you any money because you have a certain score, which in turn means you’re never given an opportunity to improve your score. When credit scores start including rent payments, I’ll be open to seeing it as equitable.

It’s not a perfect system. It’s just the best so far.

Everybody starts at the same baseline. Being born to a poor family doesn’t set you off lower than anyone else as far as credit goes, unless your parents start running up bills on your SSN, which happens, a lot. Cash and investments aren’t part of credit score at all.

Really as far as cash/cash-equivalent accounts go, just pre-paid credit cards that can impact credit, and they can only impact positively, and they are marketed exclusively towards the poor and those with bad credit.

If you want to be mad at anybody, really, it’s the predatory lenders. The payday advance companies, rent-a-centers, slumlords, and especially buy-here-pay-here car lots. Those guys that will sell and repo the same car over and over again when people don’t make payments with exorbitant interest rates.

Hell even Sprint PCS back in the day. They’d give anybody a phone with a $150 deposit.

All of them will pull a credit score at the start and then only report delinquent accounts. These are all aimed at people who are poor or have bad credit, and can only negatively impact the score.

Most of these are all run by sleazy local businessmen. Wealthy, but still exceptionally far from the super rich.

Honestly this sounds like one of the few times where the banks actually have the customers best interest (bank pun) in mind. The credit score formula is well understood (even if it’s not fully known by most people, since it’s proprietary). The risks and benefits are disclosed and agreed upon. Customers are expected to know how to use their products properly. If they do, the bankers may even sweeten the pot with some cashback or points, and provide an improvement to their reputation with the banks. If they don’t, they pay the pre-disclosed interest rates and late fees, and they earn a bad reputation with the banks.

I know it sounds like I’m shilling for the banks here. I’m not. I’m just saying this isn’t the right fight.

To turn it around, suppose you are a wealthy lender. You have three total strangers asking you to lend some cash. On what basis do you determine how risky it would be to lend them money? Or do you assume they are all an equal risk and give them all the same offer? Credit scores serve the purpose of determining how risky a credit customer is, based upon their reputation with others lending goods and services. Assuming an equal risk will either make you a loan shark, or you won’t be a wealthy lender for long.

Now, I’d be very impressed if the banks adopted a fully disclosed formula. It’s great that we can pull our full credit reports for free and see what they see, but what would be better would be to know exactly what they are basing their decisions on. It’s understandable that they’d want to keep that close to the chest, though. In a time of formula-based automatic approvals/denials, it’s only a matter of time until someone figures out how to game it.

I missed a credit card repayment by 1 day and my score dropped almost 300 points (UK. 800 (very good) -> ~500 (below average))

That’s very unlikely, there’s more to that than you’re letting on. Was the card maxed? What was your total utilization?

I paid off all of my debt and closed all of my open accounts. Credit score 515. Make it make sense. Fuck up once? 7 years of bad juju. Pay off all your debt? they forget immediately.

You need open accounts. You need to show you’re responsible with debt management. Use a credit card like a debit card, any purchase you make pay it right away.

Credit scores don’t measure financial responsibility, they measure how much money banks think they can make of of you.

The want you paying interest and account fees, even if that isn’t financially responsible.

I shat my credit into single digit range threeish decades ago (yeah, I’m a boomer puke). I couldn’t even get a bank account until about eight years ago. I finally was able to get an acct, got a secured card, and built my credit up to 729. ‘Upgraded’ my secured card to unsecured, but left the limit at $300 to keep me in check.

Then I made the mistake for applying for a modest credit line with my bank. Not only did I get denied, but the hard credit hit put me under 700. Then my credit took another major hit because I used that card for more than 31% of its limit. Never once made a late payment, neither.

As I hoped that a line of credit could afford me access to an oral surgeon (which I really need to even consider dentures, as I have mucho malo in my mouth), and as I have no interest in writing a grant to cover it, I’m fucked, as oral surgeons don’t seem to take Medicaid in my shit state.

If I survive another yearish, Medicare might be helpful, but the problems in my pie-hole might not wait that long.

I do not want a handout. I want the chance to pay it off and not leave it to Medicare…and not die of the infections spreading to either my brain (such as it is) or my heart.

(Yaay, America!)

Have you considered committing a crime and getting caught so that you can go to prison for a year or two and get free dental?

Imagine a country for which this sounds even remotely viable.

As much as I can see the appeal of gaming the system, I don’t look good in orange.

Also, I have gigs to attend to (filthy bass player here), as well as taking care of my sweetheart, who has wicked mobility issues. I don’t think I can do that from a cell.

I like the cut of your jib, tho’.

Best of luck then, friend 🙏

Even though we Australians get mostly free healthcare, teeth are still considered luxury bones that we have to pay for out of pocket too.

Why do you use credit cards in the first place? As a non American I never really understood that. Why doesn’t America just have the “normal” (from my perspective) bank cards that just let you use money from your bank account. Why do you need to borrow and pay back? It seems like such a weird system, not just weird also dangerous, where you can end up in debt.

Most Americans can’t afford a $400 emergency and live pay check to paycheck. Car breaks down, emergency medical expenses, emergency house breaks down could all cost over $400. You need a Credit card for that back up that you could eventually pay back by probably sacrificing something else. Need a car need a credit score or you pay $3-10,000 more in interest same with buying a home. Want to rent need a credit check. Want to get a job at a bank, military contractor, some government positions, and other secure jobs. They want to make sure you don’t have bad credit or can’t be taken advantage of . Which no credit is often considered bad credit.

If you don’t have 400 in savings and live paycheck to paycheck how can you borrow 400? Like how can you pay that back? It still seems really weird, and if you can somehow pay it back, why didn’t you save a small amount before the car broke down?

Agreed. Weird system, and dangerous for many. That’s why I only allow myself a very limited card, which is what I used to build my shitty credit back up.

American here. We have normal cards, they are called debit cards and are what most people use. Generizing a lot here, but credit cards are for people who were never financially educated, desperate poor people, or people who only use them to get plane miles or cash back.

It’s absurd to me to put myself in debt for all but the most desperate of cases.

Thanks, I didn’t know that, you always hear about credit card (debt) but never about debit cards. Can you still use the for a good credit score?

Most good credit cards have some form cash back, as in they give you a little bit of the credit card processing fee they place on merchants. Credit card benefits vary from card to card.

We use credit cards so much because it builds our credit score, which makes it significantly easier to take out loans for large purchases (eg car, house, etc) or rent an apartment.

We do have “normal” cards, they’re called debit cards. You are right that it’s weird and bizarre and dangerous. You shouldn’t be using credit cards if you’re living paycheck to paycheck imo.

Credit cards offer more fraud protection, at least where I live, while debit cards offer nothing much. I buy on credit and pay it off fully every month.

It seems there are details missing from your story. I find some similarities to your story to my credit history and I’ve had drastically different results.

Also, single digit credit scores aren’t a thing.

What’s a “boomer puke”?

Not really any significant details missing.

The single digit score was what I was told by a friend in banking who looked it up for me, years ago, but I’m not arguing with you, as I didn’t see it with my own eyes. She could have been lying.

Boomer = old person. Puke = asshole, fucker, or other insult.

It actually sounds like the opposite.

Your “good” credit card customer is presumably paying more credit card fees on accounts so is actually less sound financially.

So if you mean playing the rules means paying higher fees to credit cars companies then that just helps show how stupid the system is.

Also, I actually disagree fundamentally with the argument. If it’s just based on how old your accounts are then that is a shitty system. It’s not only easy to play by the rules, but then presumably to abuse them as age of an account doesn’t indicate much about your ability to pay off bills.

Credit scores aren’t a measure of financial stability or trustworthiness, they’re a measure of how much money the bank thinks they can make from you.

So if you pay off a loan early, then they aren’t making money on your interest payments, so that negatively affects your credit score.

So this is kind of a breakdown of how it works. My 3 credit scores are all in the 800s, I only have one pay fee card and we’re likely canceling it soon as we’ve got other cards that have better cash back deals. Here are a number of things that affect your score:

Using your cards, but not having a big balance on them monthly (we pay ours off, if not completely then the statement balance to avoid interest, but typically we pay them completely if we can)

Not missing any payments (haven’t missed a payment in the 12ish years we’ve had cards)

Not having derogatory marks (credit dings from stuff like not paying debts or repossessions of cars or that sort of thing would hit hard)

Any temporary hits like applying for a new line of credit (cards, loans, mortgages)

Average age of credit (older lines help a lot, it hurts less to close a newer card than an older one)

Number of accounts, they want you to have a lot, over 12 I think is where it really positively impacts your score, and it can hurt you to only have a few

Anyway it’s a complex system that’s annoying and can be difficult to understand

They’re not even subtle about it. The system directly rewards you for being in enough debt to always be paying someone interest but not enough that you might file for bankruptcy.

The credit score is based on how much money the banks think they can make off of you, not your moral standing.

I should partner up with someone who does that while I do the consistent thing and we cover each other.

Wait.

That’s illegal.

Is it? Why?

Reasons.

To play devil’s advocate, I wouldn’t trust a parachute that’s never been deployed or one that’s deployed every day for the last year. I want the parachute that was used maybe a dozen times over the last few months so that it’s not brand new but not overused so I know it works but isn’t a significant risk.

I have no idea how to calculate reliability, that’s just what monke brain thinks.

You don’t have to be in debt, but you do need open credit lines. Having debt on them actually makes your score worse.

Her score likely went down because she closed out a credit line, i.e the open loan, so technically she cant use “i have neen paying off a 5yr loan diligently” as part of her score.

I don’t know why this dude is getting downvoted. This is basically what I do. And I have a great score.

I think the only way we will know this is real is if you post your social security number too. You know, for science.

Yeah I dug into all this a while back while I was trying to raise my score. Turns out the most productive thing I did was just ask my current cards to up my limit. A couple of them doubled, so it dropped my utilization way down, which shot my score way up. I think I was around 675 and went up to 750 just with that trick. I got into the 800s by paying off the credit cards.

Its an annoying metagame you have to play to get the “good interest rates,” but those little tricks can save you a fuckton of money over time.

I think the point here though isn’t as much ‘how do we play the game?’ as it is why there hell are we all forced into playing a metagame that is so inherently harmful and specifically designed to encourage risky behavior (I.e. the idea of debt being favorable)?

why there hell are we all forced into playing a metagame

Because the alternative is “how white are you”

It’s a measure lenders use to figure out how likely they are to make money from loaning to you. It’s a very successful metric for them. It’s not really for your best interest, but if you’re aware of what goes into it there are simple, harmless things you can do to raise your score and help you get better rates.

Yep, find credit cards with no monthly fee and open them. I have 3 lines of credit and only use the one with the highest benefits. I pay off the bill after it hits my statement, and my credit is always 780-790. Also, like you said, up your limit if you can to get a higher debt to available credit ratio.

Try paying it off before it hits the bill. I bet you can squeeze a few points out of it. A friend and I both do that and I’ve been at 804 since summer and his sits between 810 and 815. Although in truth there’s no real difference between your lowest and my friend’s highest in terms of what interest rates you’ll get.

Every time I’ve done that it seems to tank my score by like 10 points. No idea what that’s about, the whole system is so convoluted its hard to tell what really makes it go down when it does sometimes.

It’s fucking weird for sure. If it works for you, do it.

You do have to use them a little bit though. It wasn’t a great surprise to learn that my credit score evaporated right when I was looking to buy a house because a credit card I hadn’t used in 7 years was turned off due to not using it. Having no debt, lots of savings, and decent income apparently counts for nothing.

Having no debt,

This is the only part the credit reporting agency sees. In that situation they have to make the lending score base on your history, which tells them nothing of your current situation.

lots of savings, and decent income apparently counts for nothing.

The credit reporting agencies don’t see any of this. There is no component in a credit score for your savings or income.

Sure, the credit agency doesn’t see it, but the person I’m talking to at the bank to get a loan can see it when I show it to them. But it doesn’t matter and they only really seem to care about the credit score.

While this is all technically correct it’s still dogshit that your score goes down when you do the thing you are supposed to do with a loan.

Your options are:

Take out a loan and pay it off: score goes down

Take out a loan and don’t pay it off/default: score goes down

Seriously. “I rarely take on debt, regularly save aggressively, and pay off my debts as quickly as is convenient” means I’m bad to loan to in their eyes when if you had evidence of all that as an ordinary person I’m exactly who you’d want to loan money to.

That’s how I’ve tried to be (and currently have no debt!).

When I needed to buy a car a few years ago, they gave me a terrible rate because I had a bad score. I had paid off a couple of personal loans AND all my student loans…but it’d been a few years so my credit score had dropped. So fuck me for not borrowing money every day.

I ended up doing a co-sign for a better rate. And guess what? I paid off that car loan a couple years early and got dinged on my credit just like the original post.

But I know they don’t care about any of that and are actually mad I didn’t pay the minimum for the entirety of the loan.

If I would loan money to people, I want them to pay me back as soon as they can. But if I wanted to make money with loans, I’d want my customers to pay their loans as slowly as possible to put a lot of interest rates in my pocket.

Your second option is 2 options. You dont need to default, just never finish paying it off.

The terms of a loan boil down to “we’ll give you x, pay it back plus interest in y amount of time”. How do you stretch something with a legally binding predetermined end out indefinitely without hurting your score or financial wellbeing?

Take out a personal loan for the balance?

Isn’t that just kind of burning money at that point, i.e. harming your financial wellbeing? Also, aren’t personal loans seen as “bad” for credit score purposes? I had to take one out a few years back and my score dropped like 45 points within the week

Maybe you could just keep refinancing over and over until you’re making 0.01 payments a month on 100 loans. And have a max credit score.

Real-life min/max’ing right here

Remember that your credit score doesn’t exist for you. It’s not for your benefit. It’s for the benefit of lenders, and they don’t give a damn how unfair the system is.

This is what people are missing. Credit score is a completely valid metric, but it’s just a measure of how likely lenders are to make money off of you.

What I don’t get is: since she paid off her car loan, she’d have more disposal income now…? Shouldn’t that increase her credit score?

Ah! I get it. So it’s a valid metric in theory. It’s shit for everyone in practice.

There’s a mess of things that go into their formula, but as I recall one of them is actively paying on things. We had our daughter get a credit card and told her that, instead of using her ATM all the time, she should use the credit card, but pay it off every month. Doesn’t cost her anything to do that, and it builds a credit rating way more than having a card with a zero balance. Doing that, they’ll also end up raising your limit, which increases your rating too. Oh, and if you pay your credit bills as soon as they come due instead of just before the deadline, that also increases your rating.

I’m not American, but a credit card means that you owe a bank money, right? If I owe my friend money I’m in debt with him. How is having a credit card not being in debt?

Just having a credit card doesn’t mean you’re in debt. Its a line of credit. You can choose to use it and carry debt, but there’s no requirement you do so. The long term consequence is that a bank may choose to close your credit card account if you don’t use it for a long time. The shortest time I’ve had a bank threaten to close an unused card of mine was 5 years. Even then, you can by a $5 sandwich on the card, pay it off immediately, and reset that timer of non-use for another 5 years in that case. I have other cards I haven’t used for 15 years and the accounts are still active.

O wow, strange system. So you are basically encouraged to sign up for a service that you won’t use?

So I should get five more credit cards and not use them?

I feel like you meant this sarcastically, but the answer is probably yes.

The trick is to not use them though, which so many seem to struggle with. If you’re someone who struggles to manage debt, then getting more credit cards WILL BE DISASTEROUS.

So, sounds like a skill issue /s

You can use the cards, just don’t carry a balance. If you don’t use a card ever, it’s likely going to get cancelled.

The easy thing you can do is set recurring bills only to a credit card and then set that card to auto pay the entire balance each month. Something like Netflix or even your electricity bill.

Put the bill on the card, and if you don’t have the willpower to shove the card in the back of a drawer and never use it, cut it up. The card doesn’t go inactive, you don’t rack up debt or interest, and you can maintain a high credit to debt ratio.

Yep. This was a big part of my strategy when I rebuilt my credit. I have a pile of cards, several of which have a single bill associated with them. I wanted to cancel because now I have a great score and a couple of really high limit cards, but that drops my length of history.

So I’ll be sitting on these low end cards forever probably. They’ll pay a single bill, get paid off before it closes for the month (that’s the number that gets reported to the bureaus) and every month from now until I decide I never need credit they’ll report $0. Just like they have the last 5ish years.

Don’t want to set here and repeat TexasDrunk, but yeah, that’s largely what i do.

Though my solution for most cards is to buy a candy bar with each card towards the end of June every year (I have a handful of niblings who were all born end of June through July, so makes a good little treat for when I come to visit)

Yes, lenders lend to make money.

The system directly rewards you for being in enough debt to always be paying someone interest but not enough that you might file for bankruptcy.

The only interest I pay is a mortgage, but my score is over 800. It must be rewarding for something else too.

It’s been a bit since I took personal finance, but I think it takes into account your assets too.

Sorry for the negative vote, but credit score does not take into account your assets. I just dont want folks to think that might be the case. Personal assets will come into play when a creditor considers you for a loan/line of credit/etc along side your actual credit score.

Edit: Well. This is turning into a wall of text.

Credit score is based on several things:

-

Ratio of debt available to debt used. I’m trying to remember where the sweet spot is, but it’s somewhere around 10% to 20%. If your credit cards have a cumulative limit of $20k, aim for a maximum use of $2-4k. Pay off your previous balance so you don’t get hit with interest and you’ll gain credit.

-

On time payments. At the very least, pay the minimum each month, but really one should be budgeting to pay it off each month to avoid interest.

-

Oldest account. I don’t like or use my first credit card, but I still have it. Note: cards must be used periodically to keep them active otherwise they won’t be considered, I want to say every 3 months. So even for my oldest card, I have a small subscription on it that hits monthly. This gives me an active, old credit line.

-

There are “good” forms of debt where on time payments is the name of the game. These are car loans, mortgages, etc. If you have the resources, set up auto pay on these so you never have to worry. Paying them off asap will save you on interest, but it could harm your credit as that is no longer an active line. It’s likely still in one’s benefit to pay them off, but then we get into a discussion of interest vs cost of money. That’s a different rabbit hole.

Uh, there’s other stuff, but my thumbs are tired. Hope this helps someone.

I have played around a bit credit score estimators on the credit agencies sites. If they are not lying, a few things found interesting.

The largest jumps in credit come from increasing the credit limit on existing credit cards. Opening a new card is a slight decrease in the score.

Mortgage and cars loans combined (installments) are how you get to “excellent credit”. When I was renting my credit was always 60 points lower. When I bought my first home my credit hit excellent for the first time 3 months later. When I paid off my cars my credit dropped by 20 points each time.

Late payments or missed payments on any account decrease the credit card the most.

Credit scores are designed to discourage you from taking out lots of loans in short amount of time. Buy a car, your score decreases for 3 months then bounces back up.

Just a note, but your credit score went up when you got a mortgage because it takes into account “mixed loan types” like unsecured credit (credit cards) where there is no collateral and secured loans (home/boay/auto) where there is.

When you have more mixed loans that you pay without issue, your score goes up.

It helped me recall all these facts!!

Thank you!

-

Same, mostly. Use the credit card for the cash back and points. Pay the balance off every month. Only things I pay interest on is my mortgage and car.