In the words of Green Day’s new song “the American dream is killing me”

Okay, this may be just a side note, but I hope they mean “wedding (as a whole) and engagement ring” because 35 THOUSAND for three rings is excessive.

Bridal jewelry worker here. I can absolutely confirm that, yes, you can indeed spend $10k on a ring setting and stone very easily. You can also spend $35k on a single ring if you got something from Hearts on Fire or Tacori.

Most of the cost comes from the stone and not the ring setting itself though. Like you can spend maybe at most like $5k on a platinum ring setting and another $10k+ on the stone.

I’m sorry but I’m struggling to even justify spending $500 on a shiny rock.

If $100 bills are like pennies to you, you don’t even think about it.

I spent like $1,000 on a ring. Of course she divorced me later on, probably because I didn’t buy an expensive enough ring.

☹️ If that’s legitimately the reason, you are much better off getting out of the relationship that “cheaply”…

Completely agreed, and none of this is directed at you. I’m responding to more of the overall sentiment in this post.

Jewelry and designer fashion is expensive very much on purpose. Yes, there’s an obvious quality element. That doesn’t mean that a Christian Siriano gown is going to last like a Carhartt jacket or that those Louboutin boots will outlast a pair of red wings. It’s wearable art, and it also makes a social statement.

We’re not even talking that level, though. The average cost for an American wedding is about $30k, so $35k all inclusive is absolutely in the ballpark. You can obviously get married for far less, but this article is talking about the reality of the “American dream” - which is really just a middle class lifestyle - versus various average expenses. The point isn’t that you can’t get married at the courthouse for $50, or even that you shouldn’t. The point is that people who subscribe to the concept of the American dream expect to be able to live an average lifestyle. Modest house. College for the kids. A “proper” wedding. Retirement. Leaving something behind. Those are increasingly moving out of reach.

You could hop over to Tiffany right now and find a nice necklace for $10k that would make a lovely Christmas present. That’s not what this article is talking about. It’s going beyond the basic “basket of goods” economists use to look at things like inflation and cost of living to include expenses that the average middle class family has traditionally expected. That’s exactly the approach many of us wish more people would take.

Very true. So. Hmmm, well - so Okay then! So what! I say let’s forget the “american dream” then, and concentrate on the things we enjoy that make us happy to get out bed in the morning. Maybe there’s more to life than just a big house and a nice car. Not that there’s anything wrong with that!

I’m with you in spirit, but keep in mind the US is still making tons of income overall as a nation - GDP is, and has been, trending up for a long time. That money’s going somewhere.

It’s like if we all ran/worked in a business and saw we’re making tons in profit but we were then being asked (regularly) to take a pay cut. It ain’t right.

That said, yes we all need to learn to live with less because it ain’t getting fixed for at least another generation or two, if ever

GDP is, and has been, trending up for a long time.

That’s because GDP has been inflated to high hell. Military spending and real estate both contribute to GDP as well - notice how high both of those things are in the US?

Some costs might be lower or higher, depending on a family’s goals. For instance, some might pay for more than one-year of college for their children, while others might buy fewer cars.

Wedding and engagement ring: $35,800

One year of college for two kids: $42,080

Pets: $67,935

Average cost to buy a home, including lifetime mortgage payments: $796,998

Are you really buying a house if you never finish paying for it?

Yes, because you have equity. You have partial ownership from the first payment until the last. If shit hits the fan, you can choose to sell it for whatever your portion of ownership is worth.

You also don’t (generally) have to ask permission on what you do with your property.

And you effectively never truly own the house, if you stop paying property taxes on it the city/county takes it.

Stop dreaming, start killing the billionaires.

Imagine outlawing plastic bags/straws before private jets.

Keeps the masses busy. I guarantee they have plastic straws on those private jets.

You don’t drink champagne with a straw

I feel like I read a same article like this every 3 months

Considering the Earth is dying and society will probably collapse in the next 20 years, there’s no “retirement plan”. You either die in your work boots at 90, get shot in the water wars, or starve to death once agricultural zones turn to sand.

Buy the game you want. Tell that hot person you’re into them. See as much as the world right now as you can.

Sure, there’s a COL crisis right now in North American, but in 20 years we’ll look back at right now as “the good times”.

… median lifetime earnings for the typical U.S. worker stand at $1.7 million…

And Musk makes over 3.5x that amount in a single day.

Three and a half lifetimes of work per day, and nobody wants to do anything about the billionaire problem?

When are you mental midgets gonna realize money is so imaginary at this point, that it’s no longer finite? What anyone else has in the bank has zero bearing on what you have. Intellectually honest people would just admit they’re jealous instead

You’re half right (there is no finite pool of money) but your conclusion is bonkers. Rich people are not spending their money, they’re using it to outbid each other for control of existing assets. So that they can overcharge ordinary people to access the things that they need.

The boots are not that tasty. Stop fucking yourself over for a chance to lick them.

Always the same. Someone says what amounts to quit whining and try, the excuses start

If money is imaginary then why can’t we guarantee food, shelter, clothing, and education for every single human on this planet.

Cause fuck em, that’s probably why

Nope, the Big Brain Compassionate People have since informed me that the American Dream™ is ONLY that you have the OPPORTUNITY to maybe afford that life.

So the American Dream™ is that CEOs exist, you can be one. The end. Get fucked Mr.Factory worker, your time passed and even though we still need you we don’t care about your quality of life, just be a CEO.

It’s amazing, because in that world the American Dream™ is literally impossible to deny. Rich people will always exist and Big Brains will always point to them and say “you can be that” so shut up.

Learn to invest and grow money ffs, don’t just squander your income. At the bare minimum understand compound interest. The earlier the better

“Have you tried being richer?”

More like have you tried using your income more effectively?

They guy with an extra 10$ a month invested isn’t in the same stadium as the guy with an extra 3k a month invested. 1 can retire, the other goes broke or in debt if they have car problems.

Right until that next market crash. Dad was really happy in 2007.

You lose if you sell during a crash. If you bought literally just before the GFC and didn’t sell, you would be up +313% on S&P 500. Buying at the worst time pre-GFC would have you negative for only 5 years.

Yeah I agree but if you planned to retire or planned to pay for a house or your kids college with that money you are SOL. Now you have to wait again on things that are time sensitive.

The idea that workers can’t understand compound interest, as though it’s some crazy new idea, is a lie told by Capitalists to split the labor Aristocracy against the rest of the Proletariat.

Everyone knows that investing is good. Lying to engineers and doctors that they are somehow smarter and better than people who can’t afford to invest just because engineers and doctors often can afford to invest is just a way for the bourgeoisie to protect itself from a United Proletariat.

What delusional nonsense are you dribbling? You’ve created some side argument for yourself nobody is talking about

You’re blaming people’s struggles with financial goals on poor planning and financial literacy, and making it a personal failure, rather than a systemic one. The reality is that people already understand basic financial literacy, but simply don’t have enough income to meet basic financial goals regardless of budget.

Okay grandpa. With what money? I only own a house due to inheritance.

Owning a house means no rent, most people blow 30% of their income on rent. Use that

Can you give us a rundown on what you think is a good plan?

If we need to learn about compound interest. This is a good time to teach us.

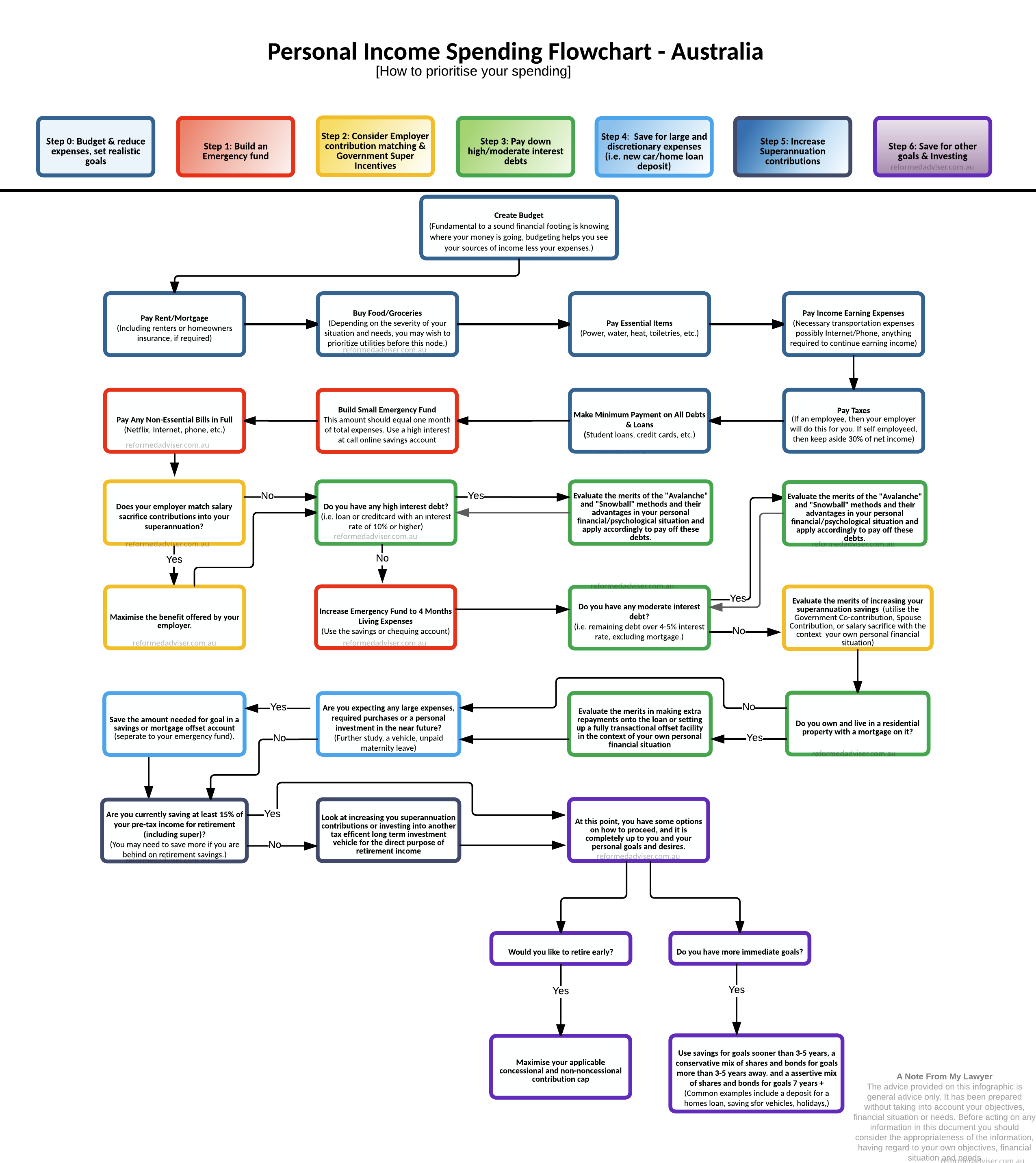

Understand compound interest, how money grows over time. Learn to maximise your interest rate on savings and minimise interest rate on debts. If you have enough savings for an emergency fund, start investing excess savings into investment options that meet your personal risk threshold. Low risk options exist with high average yields (about 8%) like low fee ETFs tracking S&P 500 or other market indexes. My superannuation fund (retirement fund) has an average annual return of 12% for the past ten years, yields higher than this could impart higher than average risk of negative returns. Starting as early as you can lets you reap the benefits of compounding interest, snowballing income. Note that as interest rates go up, stock market returns usually decrease. If buying US stocks, make sure you DRS them otherwise you don’t own them. I’m not a financial adviser, I’m just savvy with retail investing

This flow chart is Australian but should loosely apply elsewhere too

Thats some nice info, but it doesn’t explain what compound interest is.

When you get regular interest payments, that interest adds to the amount in the account so every interest payment your total interest paid increases. You can snowball this into a sizable figure with time, it pays more per year the longer you do it due to the snowballing. Especially if you find good interest rates and regularly review them

And where are these good interest rates and compounding services?

Essentially any account/financial product that pays interest into the account is compounding. Good interest rate accounts will vary on your country/area. Start by comparing savings account interest rates between your local banks and seeing if there are any special things you have to do to get the best rate. For example here with some banks they will pay an extra few % if you don’t lower your savings account balance that month

Save up a million in 401k, investments and equity just to spend it all in a couple of years for senior care.

To put it in perspective… I inherited my mom’s house, retirement, life savings, car, etc. And I am still very limited in buying a new home where I actually want to live, bc of how outrageous prices are. Just imagine… almost 70 years of her life, and I can’t do what my dad and his first wife easily did at age 20 working as a restaurant manager. Insane.